Stablecoin titan Tether has officially deployed $100M into Anchorage Digital, the San Francisco-based crypto custodian. It’s a strategic pivot.

Instead of just providing liquidity, the $USDT issuer is buying its way into the bedrock of regulated digital asset infrastructure. The capital is largely aimed at backing $USAT, a new stablecoin tailored for the US market, using Anchorage’s status as a federally chartered crypto bank as leverage.

Tether is effectively buying regulatory air cover and institutional rails. By partnering with Anchorage (which holds a charter from the Office of the Comptroller of the Currency), Tether is signaling a hard shift toward compliance-first expansion. It comes right as traditional finance firms are scrambling for ‘safe’ entry points into the digital asset economy.

But while institutions fortify the custody layers, the real infrastructure revolution is happening on the Bitcoin network itself. As Tether locks down banking rails, smart money is rotating into execution layers designed to unlock Bitcoin’s dormant capital.

This search for yield has directed massive volume toward Bitcoin Hyper ($HYPER), a project fixing the ecosystem’s single biggest flaw: Bitcoin’s inability to scale for DeFi.

SVM Integration Answers The Bitcoin Scalability Trilemma

For years, the bottleneck preventing Bitcoin from moving beyond ‘digital gold’ was technical. The network is secure, sure, but it’s notoriously slow and can’t handle complex contracts.

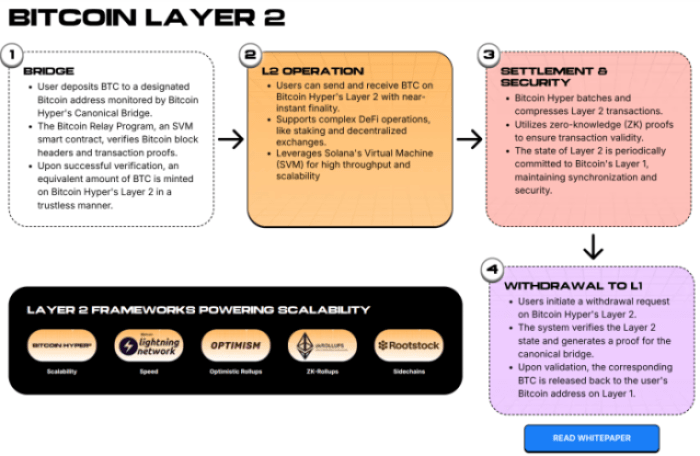

Bitcoin Hyper ($HYPER) is dismantling that barrier by integrating the Solana Virtual Machine (SVM) directly as a Layer 2 solution. It’s a massive architectural shift. By using the SVM, Bitcoin Hyper delivers sub-second finality and Solana-grade throughput, all while settling on the Bitcoin network.

It’s the best of both worlds scenario that developers have chased for a decade. Previous Bitcoin L2 attempts usually suffered from high latency or centralization risks. By employing a decentralized canonical bridge and a modular structure, Bitcoin Hyper allows high-speed payments and complex apps, swaps, lending, and gaming to run on Bitcoin without clogging the main chain.

The implications are massive. If holders can deploy assets into high-yield DeFi protocols with Solana’s speed, trillions in dormant $BTC capital could be unlocked. The architecture mirrors the modular scaling thesis that dominated Ethereum’s roadmap, finally applying it effectively to the Bitcoin ecosystem.

EXPLORE THE $HYPER ECOSYSTEM

High Project Conviction Signal – Whales

The market’s appetite for this solution is visible in the on-chain data surrounding the $HYPER presale. According to live metrics, it has already raised over $31M, a figure that suggests validation from both retail and sophisticated investors.

With the token currently priced at $0.0136751, early positioning is aggressive before the protocol hits its Token Generation Event (TGE).

It’s also worth noting that a big signal of conviction in the project is bellowing – whales. Etherscan data reveals high-net-worth wallets have spent over $1M. The largest transaction was for $500K. That type of accumulation during a presale shows whales hedging against listing volatility by securing an entry price well below projected market value.

The $HYPER incentive structure is designed to lock in long-term liquidity. The protocol offers high APY staking immediately after TGE, with a modest 7-day vesting period for presale stakers. This reduces immediate sell pressure and aligns investor interests with the network’s stability.

As Tether creates a regulated environment for stablecoins, Bitcoin Hyper is building the high-velocity rails where those assets can actually be used.

BUY YOUR $HYPER ON THE OFFICIAL PRESALE PAGE

The information provided in this article is not financial advice. Cryptocurrency investments carry inherent risks, including high volatility and potential loss of capital. Always conduct your own research (DYOR) before making any investment decisions.